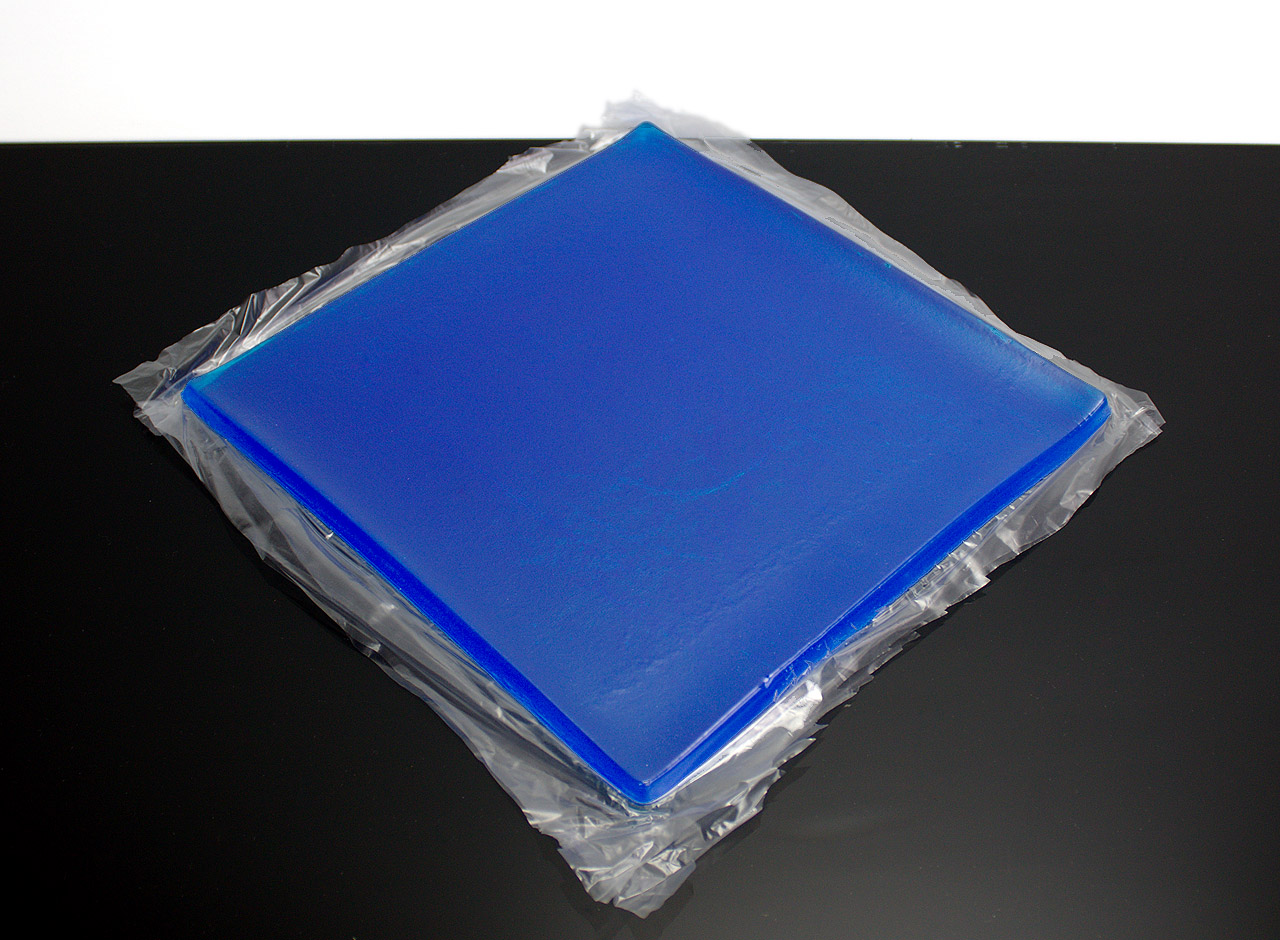

Domeilleur Gel Sitzkissen Atmungsaktiv Absorbiert, Gelmatten für bequemen Motorradsitz, Komfort Motorrad Sitz Gel Pad Stoßdämpfung Matten Kissen Zubehör Motorrad Sitzkissen 25*25*1cm : Amazon.de: Auto & Motorrad

Tourtecs - Motorrad Sitzauflage Kompatibel für Gel Pad Sitzbank Gelkissen Neopren M Schwarz Komfortkissen Motorrad : Amazon.de: Auto & Motorrad

2CM Motorrad Sitz Kissen Gel Pad Cool Pad Stoßdämpfung Matte DIY Cut Kissen Blau Für Motorrad Autostuhl Kissen günstig kaufen — Preis, kostenloser Versand, echte Bewertungen mit Fotos — Joom

Motorrad Sitz Gel Pad Dämpfung Matte Motorrad Roller Komfortable Weiche Eis Kühler Kissen Motor Bike Modifizierten Sitz Pads - AliExpress

Wasserdicht Gel Pad Motorrad 3D Mesh Motorrad Sitzkissen Rutschfeste Kühlung Unten Motorrad Sitz Gel Pad Zubehör _ - AliExpress Mobile

PJhao Motorrad Sitz Gel Pad Gel Sitzkissen Dämpfung Matte Komfortable Weiche Kissen Stoßdämpfung Matten Kissen Zubehör Motorrad Sitzkissen Blau : Amazon.de: Auto & Motorrad

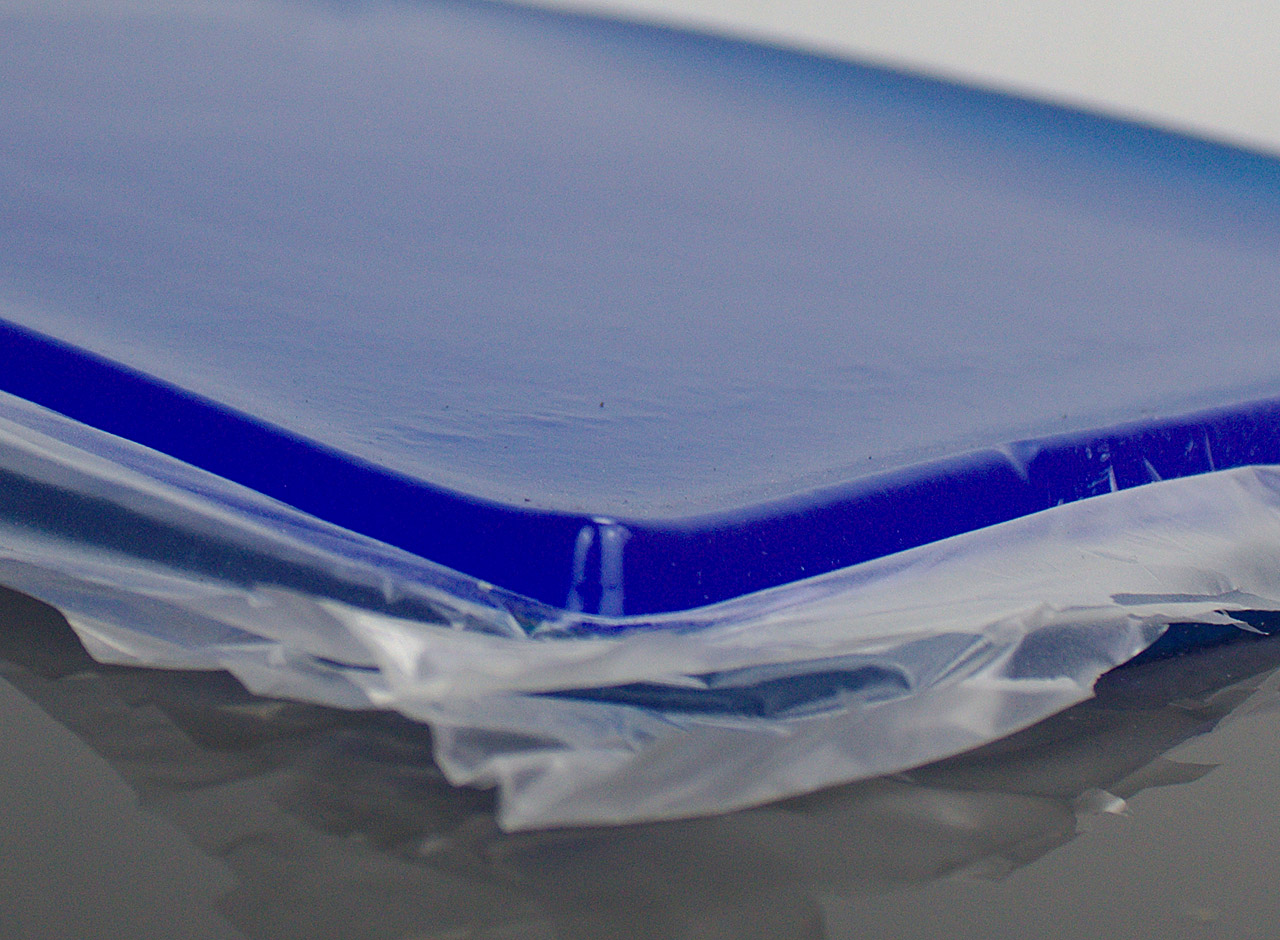

aleawol Motorrad Sitz Gel Pad 25x25x2 cm Motorrad Gel Sitzkissen Stoßdämpfungsmatte Komfortable Weiche Gelkissen, Motorrad Sitzpolster DIY Motorrad Sitz Zubehör, Blau : Amazon.de: Auto & Motorrad

ikasus Motorrad Sitz Gel Pad,Gelkissen für Motorradsitz,Weich Motorrad Sitzbank Kissen Dämpfung Matte Komfortable Gelkissen Stoßdämpfungsmatte Kissen für Motorrad Zubehör,Blau 25 * 25 * 1CM: Amazon.de: Auto & Motorrad