مسلسلات اجنبي الحلقة 7 اكشن جريمة خيال علمي مسلسل Cowboy Bebop الموسم الاول الحلقة 7 السابعة مترجمة مسلسلات اجنبي الحلقة 6 اكشن جريمة خيال علمي مسلسل Cowboy Bebop الموسم الاول الحلقة 6 السادسة مترجمة 5.1 افلام اسيوية اثارة جريمة دراما فيلم Game ...

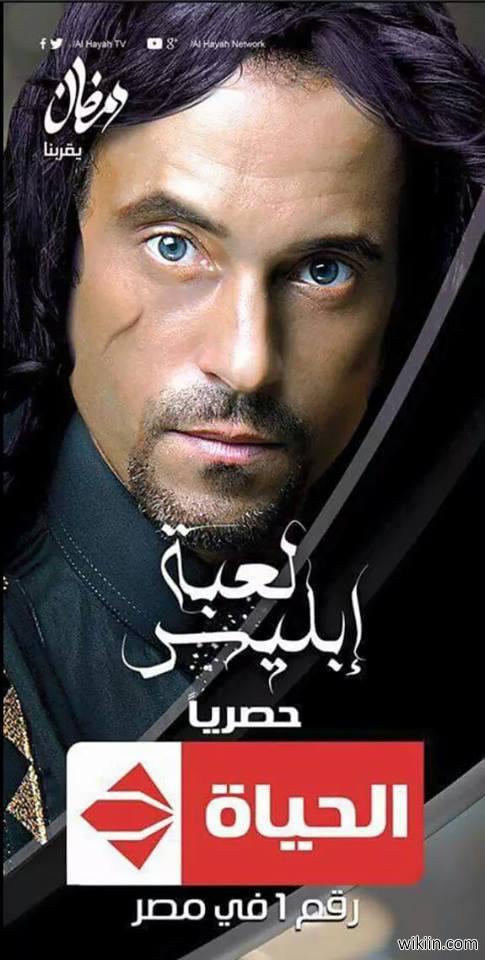

مسلسل لعبة إبليس | La3bet Abliis Series - مسلسل لعبة ابليس - الحلقة السابعة عشر | Devil Game - Ep17 - YouTube

لعبة ابليس - اقوى مشهد فى الحلقة الرابعة ... مخاوى ظابط من امن الدولة جابلى تاريخ اهلك "شيرى عادل" - YouTube