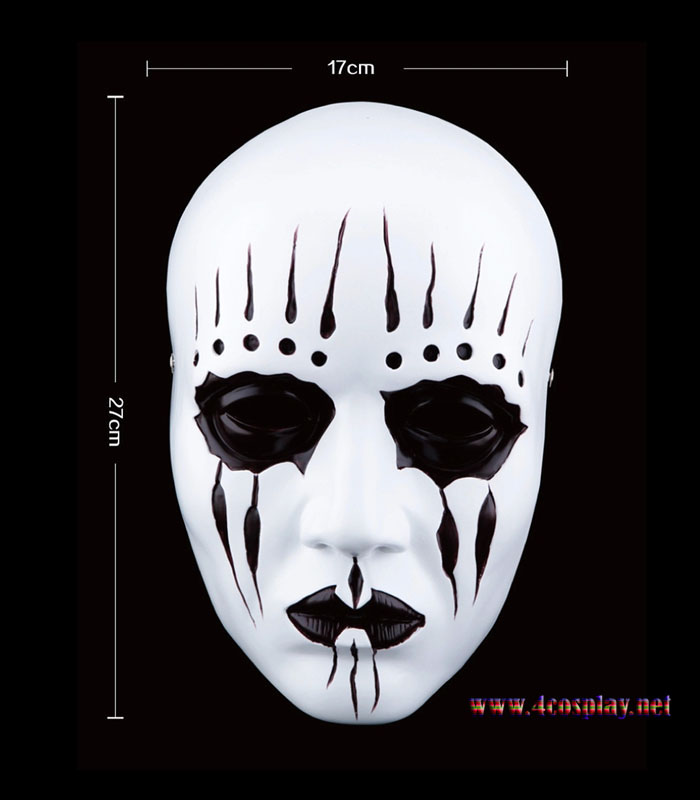

Halloween Slipknot Mask|Slipknot Drummer Joey Jordison Mask| Drummer Joey Cosplay Mask| Buy Slipknot Joey Mask

Resin Mick Thomson Cosplay Mask Halloween Masquerade Party 1:1 Replica (Copper) : Toys & Games - Amazon.com

Amazon.com: SKTY Mick Thomson Half Face Latex Mask Halloween Horror Masquerade Cosplay Costume Props, Black : Home & Kitchen

Halloween Mask with Long Hair Braid, Scary Knot Rope Mask Full Face Latex Mask Halloween Cosplay Costume Props : Toys & Games - Amazon.com

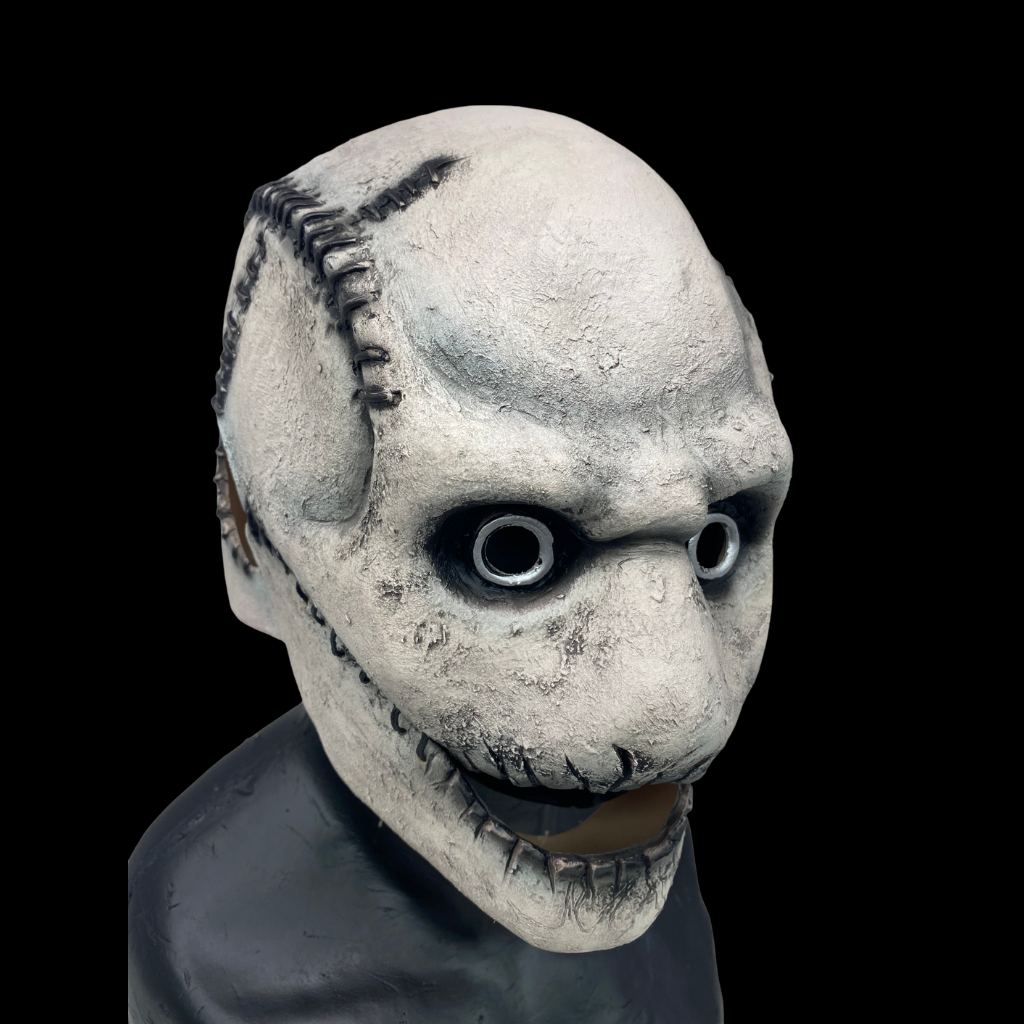

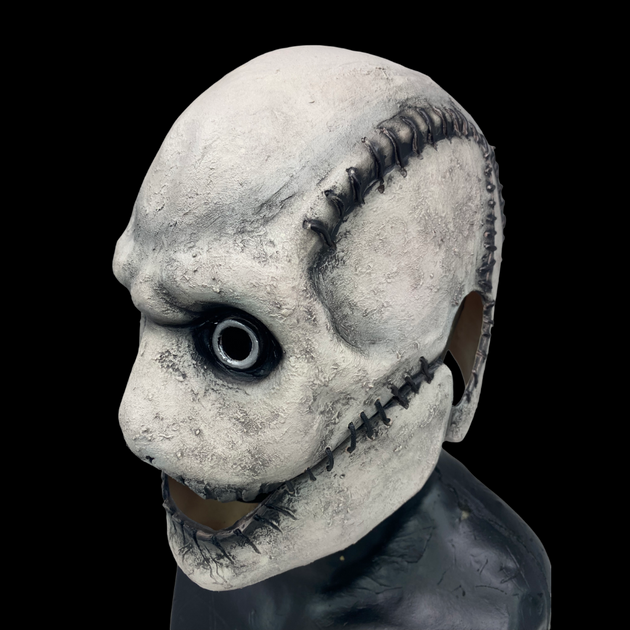

Corey Taylor Mask Cosplay Costume Accessories for Adult Halloween Latex Silver : Clothing, Shoes & Jewelry - Amazon.com

Halloween Slipknot Mask|Slipknot Drummer Joey Jordison Mask| Drummer Joey Cosplay Mask| Buy Slipknot Joey Mask